In his report of the 20th National Congress of the Communist Party of China, General Secretary Xi Jinping outlined the active and prudent promotion strategy of carbon peaking and carbon neutrality. Based on China's energy and resource endowment, incremental steps would be taken to implement the carbon peaking action plan systematically. The strategy emphasized advancing the energy revolution, enhancing the clean and efficient use of coal, accelerating the planning and construction of a new energy system, and actively participating in global climate governance to address climate change. To actively implement this national “dual carbon” strategy, conduct in-depth research on carbon market construction and carbon credit mechanism, and promote the integration of “production, education, research and application”, Energy Internet Research Institute of Tsinghua University combined the esteemed scientific research strength from China Beijing Environmental Exchange, AVIC Trust Co., Ltd., Beijing Green Finance Society, State Grid New Energy Cloud Carbon Neutrality Innovation Center and others, and compiled of Global Carbon Credit Development Report (2022). On November 13, 2022, Mei Dewen, general manager of China Beijing Environmental Exchange, delivered the pre-release of the Global Carbon Credit Development Report (2022) at the Annual Conference of the Green Finance Committee of China Society for Finance and Banking 2022 on behalf of the project team, and presented the data analysis results and key contents of the report.

The report started by examining major global carbon credit mechanisms, summarizing their characteristics, and highlighting their development challenges. It systematically reviewed the types, geographic distribution, annual estimated emission reductions, issuance, and trading status of global carbon credit projects, and particularly focused on analysing the characteristics of China’s registered projects within major global carbon credit mechanisms and the composition of issued assets. Furthermore, the report addressed the current hot topic of carbon credit trading, which is the integration of blockchain technology, elucidating its technical characteristics and quantitative analysis results. It described a future for carbon credit trading regarding market integration and development, credit system improvement and the application of emerging technologies. Last but not least, the report provided suggestions and advice for the development of China’s CCER (Chinese Certified Carbon Emission Reduction) market. It would guide and support relevant decision-making authorities and industry practitioners in formulating policies and development strategies for China’s carbon credit market.

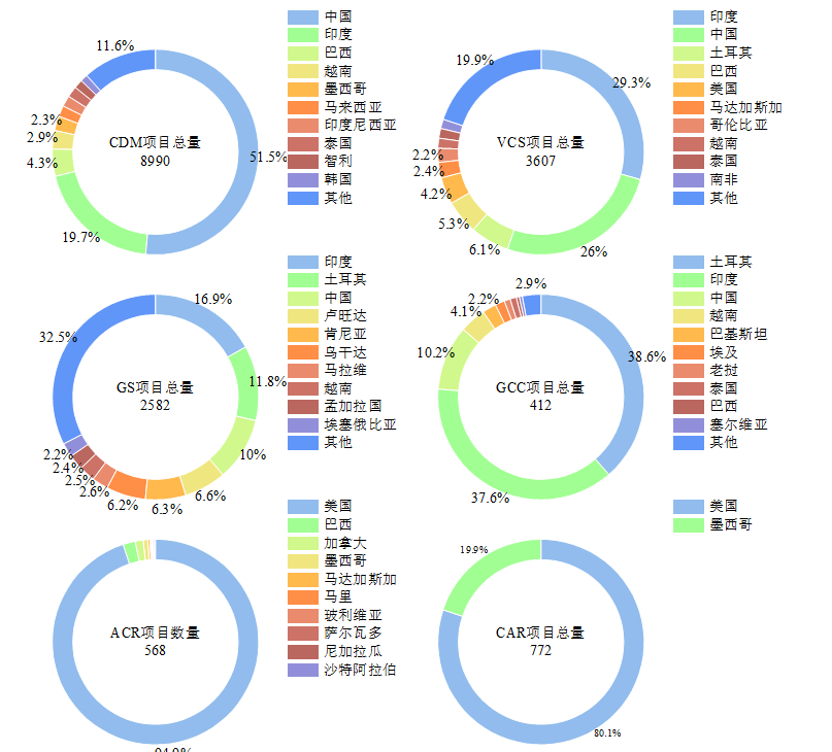

Figure 1: Project distributions around the world for 6 carbon credit mechanisms

VCS项目总量8990 |

Total VCS projects 8,990 |

中国 |

China |

印度 |

India |

巴西 |

Brazil |

越南 |

Vietnam |

墨西哥 |

Mexico |

马来西亚 |

Malaysia |

印度尼西亚 |

Indonesia |

泰国 |

Thailand |

智利 |

Chile |

韩国 |

South Korea |

其他 |

Other |

VCS项目总量3607 |

Total VCS projects 3,607 |

印度 |

India |

中国 |

China |

土耳其 |

Turkey |

巴西 |

Brazil |

美国 |

USA |

马达加斯加 |

Madagascar |

哥伦比亚 |

Colombia |

越南 |

Vietnam |

泰国 |

Thailand |

南非 |

South Africa |

其他 |

Other |

GS项目总量2582 |

Total GS projects 2,582 |

印度 |

India |

土耳其 |

Turkey |

中国 |

China |

卢旺达 |

Rwanda |

肯尼亚 |

Kenya |

乌干达 |

Uganda |

马拉维 |

Malawi |

越南 |

Vietnam |

孟加拉国 |

Bangladesh |

埃赛俄比亚 |

Ethiopia |

其他 |

Other |

GCC项目总量412 |

Total GCC projects 412 |

土耳其 |

Turkey |

印度 中国 |

India China |

越南 |

Vietnam |

巴基斯坦 |

Pakistan |

埃及 |

Egypt |

老挝 |

Laos |

泰国 |

Thailand |

巴西 |

Brazil |

塞尔维亚 |

Serbia |

其他 |

Other |

ACR项目数量568 |

Total ACR projects 568 |

美国 |

USA |

巴西 |

Brazil |

加拿大 |

Canada |

墨西哥 |

Mexico |

马达加斯加 |

Madagascar |

马里 |

Mali |

玻利维亚 |

Bolivia |

萨尔瓦多 |

El Salvador |

尼加拉瓜 |

Nicaragua |

沙特阿拉伯 |

Saudi Arabia |

CAR项目总量772 |

Total CAR projects 772 |

美国 |

USA |

墨西哥 |

Mexico |

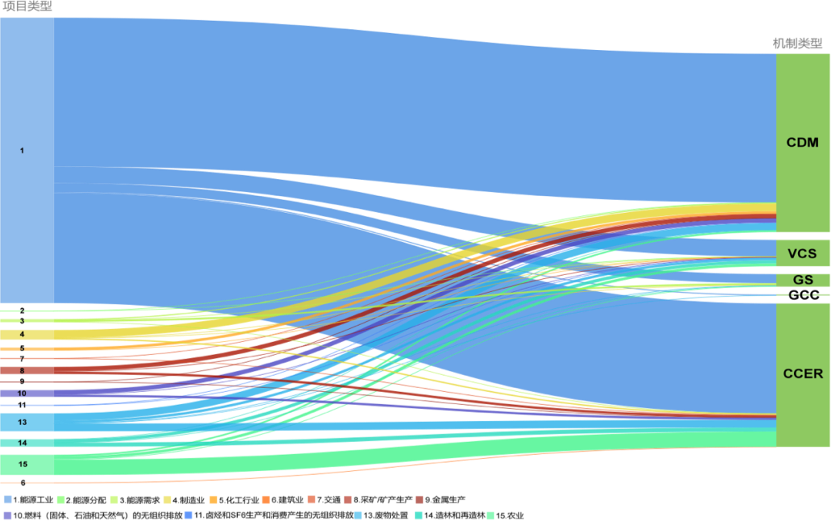

Figure 2: Composition of China’s registered carbon credit project types

图字:

项目类型

机制类型

1.能源工业

2.能源分配

3.能源需求

4.制造业

5.化工行业

6.建筑业

7.交通

8.采矿/矿产生产

9.金属生产

10.燃料(固体、石油和天然气)的无组织排放

11.卤烃和SF6生产和消费产生的无组织排放

13.废物处置

14.造林和再造林

15.农业

Project Type

Mechanism Type

1. Energy Industry

2. Energy Distribution

3. Energy Demand

4. Manufacturing Industry

5. Chemical Industry

6. Construction Industry

7. Transportation

8. Mining/Mineral Production

9. Metal Production

10. Fugitive Emissions from Fuels (Solid, Oil and Gas)

11. Fugitive Emissions from Production and Consumption of Halocarbons and SF6

12. Waste Disposal

13. Afforestation and Reforestation

14. Agriculture

Accelerating the restart of a voluntary greenhouse gas emission-reducting trading market that aligns with China’s national conditions and reflects China’s characteristics will greatly enhance the financing capacity of low-carbon projects. It is not only a crucial pillar in the comprehensive establishment of China’s carbon trading system, but also an urgent requirement for achieving the goals of “carbon peaking and carbon neutrality”. At this stage, in-depth research on the development characteristics and trends of global carbon credit mechanisms is essential. We can draw on the lessons of major mechanisms and trading experiences to promote the conversion and large-scale development of low-carbon technologies, achieving high-quality supply at the scale of China’s carbon credits. The establishment of an effective, liquid and stable Chinese carbon credit market is of great importance, not only for domestic purposes but also for actively participating in the construction of the global carbon market.

Figure 3: Cover of Global Carbon Credit Development Report (2022)

图字:

全球碳信用发展报告

Global Carbon Credit Development Report

(2022)

清华大学能源互联网创新研究院

Energy Internet Research Institute of Tsinghua University

北京绿色交易所

China Beijing Environmental Exchange

中航信托股份有限公司

AVIC Trust Co., Ltd.

北京绿色金融协会

Beijing Green Finance Association

国网新能源云碳中和创新中心

State Grid New Energy Cloud’s Carbon Neutrality Innovation Center

2022年11月

November 2022